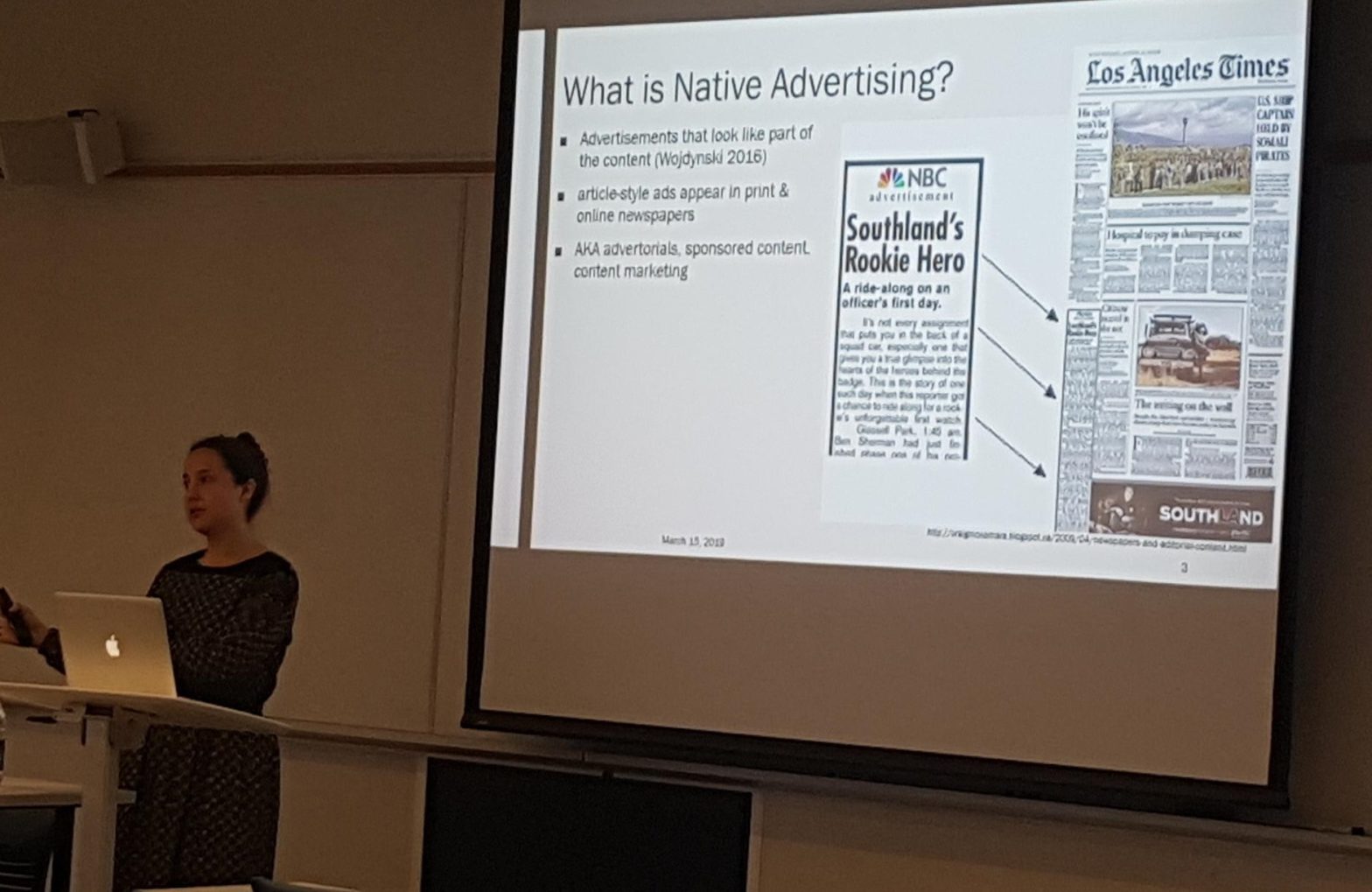

On March 15, 2019, Sarah Cornwell, LIS PhD Candidate, gave a talk, entitled “Covert Advertising: How marketing is hidden in Canadian Newspapers” as part of the “Guest Speaker Series on Misinformation, Disinformation” in FIMS9328 Graduate Course at Western University.

On March 15, 2019, Sarah Cornwell, LIS PhD Candidate, gave a talk, entitled “Covert Advertising: How marketing is hidden in Canadian Newspapers” as part of the “Guest Speaker Series on Misinformation, Disinformation” in FIMS9328 Graduate Course at Western University.

Sarah worked on distinguishing features of native ads (or sponsored content) by contrast with editorials, as part of the SSHCR-sponsored project at LiT.RL. Our findings were recently presented at the HICSS2019 Conference. The full paper is available in the HICSS2019 Proceedings (or you can access a pre-print via ResearchGate).

Guess which text is a native ad: excerpt A or excerpt B below?

| A. Is the end of the cheque in sight?

“The cheque is in the mail.” For decades, this phrase was a convenient, if dubious, excuse for someone who was late with a payment. It wasn’t so convenient for the person who was owed. The first printed cheque was introduced by the Bank of England in 1717, and by the late-20th century in Canada, cheques had become a mainstay of payment for everything from rent to wages to groceries. But thanks to innovations in payment technology, the reign of the cheque is waning, as Canadians adopt digital payment methods offering greater convenience and efficiency. In the past five years alone, innovation in cashless payment technologies have, in many ways, surpassed the 300 years of history that came before it, says Carmi Levy, technology analyst for CTV. |

B. Interac’s tap-and-pay launch had to be done right

It’s probably no big deal for you to tap your debit card at the store, but for Mark O’Connell at Interac (below), launching flash-and-pay technology in 2010 was one of the biggest decisions he and his organization had to face. “We had to get it right. We’re the backbone of Canada’s debit payment system,” says Mr. O’Connell, president and chief executive officer of the Interac Association, which operates and manages the system for banks and merchants across the country. “We do more than five billion transactions a year, so a bad decision could affect the GDP of Canada.” The decision to issue Interac, or debit, cards that can be tapped on machines like credit cards was a key one for everyone at the organization, because the timing had to be right. |